Tuesday, June 28, 2011

Monday, August 17, 2009

Sunday, August 16, 2009

alternative FUELS

Japan and the United Arab Emirates – A Nuclear Family?

David Adam Stott

Concerned about the sustainability of its oil and gas reserves, the United Arab Emirates (UAE) has been taking steps to diversify its economy and reduce its dependence on natural resource exports. The most eye-catching of these changes has been the rapid development of Dubai as a finance, services and travel hub in the last decade. A further plank in this strategy has recently been revealed: UAE plans to embark upon a nuclear power programme. Emphasising transparency and close cooperation with the International Atomic Energy Agency (IAEA), it hopes to have the first of its reactors on line by 2017.

Rather than taking the more tortuous route of developing indigenous expertise, the Emirates have been proposing joint-venture schemes with foreign contractors to construct and operate its nuclear power plants. Japan became the fourth such country to sign a bilateral nuclear cooperation agreement after France, the USA, and the UK. To secure their participation, and to maintain its image as an outward-looking, foreign investment-friendly nation, the Emirates has stressed that it will not enrich uranium itself but import nuclear fuel for its plants. These supplies will come from a foreign partner and, furthermore, the UAE will return all spent nuclear fuel rather than reprocess it. The IAEA will also have the right to conduct snap inspections and be allowed unlimited access to the nuclear sites. This stands in marked contrast to Iran, which persists with enrichment which can be used for producing weapons material despite claiming its nuclear programme is also aimed solely at generating electricity. To acquire nuclear weapons it is necessary to either pursue uranium enrichment or develop spent fuel reprocessing capabilities which can produce the necessary plutonium.

Given the furore over Iran’s nuclear programme, the UAE’s plans could potentially transform the landscape for nuclear power generation in the Middle East and beyond. Critics contend that even strictly civilian nuclear programmes could lead to nuclear proliferation in the region, especially given the risks of illicit trade and the UAE’s history of close ties with Iran. However, supporters argue that the UAE’s programme will set a good example for other potential developers of nuclear power in the Middle East, most notably Iran. At present, IAEA Director General Mohamed El-Baradei is among the many who believe that Israel is the only state in the Middle East to actually possess nuclear weapons and the means to deliver them. (Despite hiding behind a policy of so-called “nuclear opacity”, Israel is widely believed to possess between 75 and 400 nuclear warheads.) Indeed, in response to Israel’s suspected nuclear capability, many Arab states have frequently called for the Middle East and North Africa to be free of nuclear weapons. Given the lack of American pressure on Israel, Iran’s enrichment programme and the increasing number of countries exploring nuclear power in the region, this is unlikely to materialise.

Although the UAE has so far held discussions with various nuclear producers such as the United States, France, Britain, Germany, Russia, China and South Korea, this paper will focus largely on Japan’s role in the programme. Firstly, it will briefly examine the history of nuclear power in both the UAE and Japan. Thereafter, the motivations of Japan and the other foreign bidders will be considered before conclusions are drawn.

The need for nuclear power in the Gulf

The six members of the Gulf Cooperation Council (GCC) – the UAE, Kuwait, Saudi Arabia, Bahrain, Qatar and Oman - rely exclusively on fossil fuels for electricity generation and have been experiencing 5-7% annual demand growth in recent years. Given their locations, water desalination also consumes large qualities of oil and gas. A 2009 report estimates that electricity demand in the GCC block will increase 10% per annum to 2015, accompanied by desalination demand rising annually by 8%, in total requiring 60 gigawatts of electricity (GWe) of new capacity by 2015 (World Nuclear Association, ‘Nuclear Power in the United Arab Emirates’ June 2009).

To meet future demand, the GCC states announced in December 2006 that they were looking into harnessing nuclear energy. All six members are signatories to the Nuclear Non-Proliferation Treaty (NPT), and France quickly signalled its willingness to cooperate, whilst Iran also promised assistance. GCC members, led by Saudi Arabia, agreed in February 2007 with the IAEA to launch a feasibility study into a GCC-wide nuclear power and desalination scheme, with Riyadh envisioning a programme emerging around 2009.

However, since the IAEA submitted a pre-feasibility study to the regional body in late 2007 there has been no progress in any joint GCC nuclear programme, and various member states have consequently signed their own bilateral agreements with established nuclear energy producers. Most recently, Oman signed a Memorandum of Understanding (MoU) with the Russian Federal Atomic Energy Agency (Rosatom) in July 2009. In January 2008, Qatar and France inked a similar deal. Bahrain subsequently sealed a nuclear energy MoU with the United States in March 2008, and Manama has also indicated it will forgo enrichment and reprocessing technology and equipment. As in the UAE, it intends to purchase nuclear fuel on the international market instead. Both Kuwait and Saudi Arabia are presently discussing the content and scope of their own bilateral nuclear cooperation deals with France. An agreement with Riyadh is likely to be signed by the end of 2009. Of the non-GCC members in the region, both Yemen and Jordan have signalled their interest in harnessing nuclear energy. Indeed, the latter already has nuclear cooperation agreements with Britain, Canada, France, the United States, Russia, China and South Korea.

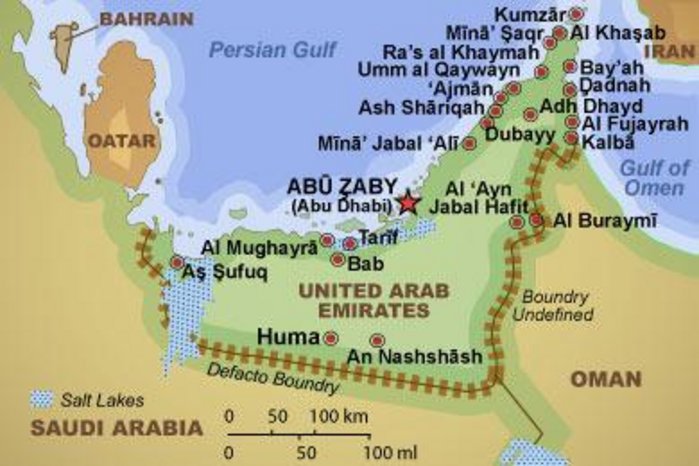

Notwithstanding, the deal with the UAE contains significantly more substance than the other bilateral nuclear cooperation agreements with other GCC members. Indeed, the UAE has been in the vanguard of such unilateral moves, and in April 2008 independently published a comprehensive nuclear energy policy outline. This white paper was assembled with input from the IAEA and the governments of France, the USA, Britain, Russia, China, Japan, Germany, and South Korea. It forecast electricity demand growing by 9% per annum from 15.5 GWe in 2008 to over 40 GWe in 2020, with natural gas supplies sufficient for only half of this. At present, around 98% of the UAE’s total capacity is derived from gas. Indeed, in 2008 Abu Dhabi, the wealthiest and biggest of the seven Emirates with the largest oil reserves, began importing natural gas from Qatar as its own deposits contain too much sulphur to make power generation cost effective. Imported coal was dismissed as an option to meet this shortfall due to environmental and energy security implications, whilst buttressing extant oil and diesel generation was also discounted due to environmental and cost concerns.

The reason for this increasing demand has been the urbanisation and construction boom of the last decade, as record oil revenues have fuelled economic expansion and population growth. Indeed, the UAE was one of the fastest growing economies in the world between 2000 and 2007, achieving a compound annual growth rate of 9.3% in the five years to the end of 2007. (Figures from Global Research, part of Kuwait’s Global Investment House.)

In particular Dubai, the largest city in the Emirates, has been at the forefront of these changes, as it strives to remodel its economy from reliance on almost depleted natural resource exports. For instance, the Dubai Mall is the largest shopping centre in the world and Dubailand will be the largest amusement park when it fully opens in 2012, two times bigger than Florida’s Disney World. The city is also slated to have the most comprehensive metro system, the biggest airport, the longest waterfront, and the largest indoor skiing facility. Perhaps the most startling of these developments are the three man-made Palm Islands (Palm Jumeirah, Palm Jebel Ali and Palm Deira) which will add 520 kilometres of beaches to Dubai’s coastline. A similar development is The World, an artificial archipelago of some 300 islands shaped in the image the Earth’s landmass, located 4 kilometres off the coast. Naturally, such huge projects require ever-increasing electric capacity to sustain them, straining the UAE’s power grid.

The World development, 4 kilometres off the coast of Dubai.

Power projections readjusted to account for the present global downturn are difficult to assess as no-one can safely predict how long and how deep the decline will be. Whilst some of Dubai’s mega projects will likely be delayed by the global credit crisis, its economy is still growing, albeit only by an estimated 2.5% in 2009. (According to a February 2009 estimate by Dubai’s chief economist Raed Safadi. The International Monetary Fund (IMF) estimates that growth for the UAE as a whole will fall to 3.3% in 2009 from 7.4% in 2008.) Much of this growth is being fuelled by government investment in major infrastructure projects and other public spending.

Whilst the country’s gas deposits are limited, the UAE as a whole still retains substantial oil reserves. Thus, with the high commodity prices of recent years, nuclear energy would enable the GCC’s oil and gas producers to reap rich rewards by selling more of their natural resources to foreign buyers. Furthermore, the UAE envisages it can produce electricity from nuclear power at just a quarter the cost of gas. Whilst this figure does seem exaggerated, studies from Europe and North America indicate that over time nuclear power is generally the most cost effective option for increasing the capacity of a power grid, unless a territory does not have to import coal and gas. (For an overview of studies conducted by the OECD, the European Commission and various North American institutions, see World Nuclear Association, ‘The Economics of Nuclear Power’, June 2009. Interestingly, nuclear costs were highest in Japan.)

Since the announcement of the nuclear scheme, proposed generating capacity has twice been revised upwards. The authorities originally hoped to have two 1600 megawatt (MW) nuclear plants running by 2016, but this was subsequently changed to three 1500 MW plants on line by 2020. With Abu Dhabi being the driving force behind the nuclear project, it was speculated that two reactors would be sited between Abu Dhabi and Ruwais, with a third probably on the Indian Ocean coast at Al Fujayrah. However, in May 2009 it was finally confirmed that the first nuclear power plant will be constructed at Al Bayyaa, close to the Saudi Arabian border. Construction will take place in three phases with a capacity of 5000 MW upon completion, much larger than the original projection. Thus, each phase will be 1,650 MW. First phase construction is expected to begin in 2012, with completion by 2017. The second and third phases are expected to be finished in 2018 and 2019 respectively. It was announced that the reactors will be financed by the government, without resorting to loans, although future equity partners have not been ruled out.

The gestation of the nuclear scheme gathered steam in mid-2008 when the UAE appointed an ambassador to the IAEA, and established a Nuclear Energy Program Implementation Organisation upon its recommendation. The national Emirates Nuclear Energy Corporation (ENEC) was subsequently founded, charged with facilitating all nuclear power projects within UAE. It is the ENEC which has been dealing with all the prospective foreign suppliers of technology and expertise. Rather than taking the more tortuous route of developing indigenous expertise, the ENEC has been proposing joint-venture schemes with foreign contractors to construct and operate its nuclear power plants. It is understood the UAE will standardise on one technology, namely third-generation light water reactors (LWR), the current standard in nuclear plants.

Whilst economic considerations are the driving force behind these nuclear plans, there is also a growing awareness in the UAE that it should reduce its environmental footprint. Indeed, 2005 statistics compiled by the World Wildlife Fund (WWF) revealed that the country had the world’s highest per-capita ecological footprint at 9.5 global hectares, ahead of the United States and Kuwait, and much higher than the global average of 2.1 hectares. This followed similar data from 2003 in which the UAE already had the world’s biggest ecological footprint at 11.9 global hectares, compared to 9.6 hectares for the USA and a global average of 2.2 hectares. These figures refer to the amount of productive land and sea area required to generate the consumption of an average individual but they ignore aircraft emissions. (See the WWF’s ‘Living Planet Report 2008’ which presented the 2005 data. Its 2006 report featured the 2003 data. Nevertheless, the UAE’s overall demand on global resources was less than half of one percent in 2005.) Such reports have embarrassed the Emirati authorities somewhat and provide another justification for nuclear power. Unlike power generation from coal, oil or natural gas, nuclear power plants do not emit carbon dioxide. Instead, the energy locked inside the nuclei of uranium atoms is turned into electricity. Therefore, despite the accident hazards and the problem of radioactive waste treatment, nuclear power is championed by some as a ‘clean’ alternative to fossil fuel power generation.

Indeed, the nuclear option is just one of the UAE’s resource-conserving schemes. In 2006 Abu Dhabi unveiled its plans for Masdar City to become the world’s first zero-carbon city, power for which will primarily come from a large photovoltaic solar power plant. The first phase, already the largest solar power grid in the Middle East and North Africa, opened in July 2009. With renowned architect Norman Foster at the helm, it is hoped that car-free Masdar will be completely self-sustaining, being key to Abu Dhabi’s transformation into a world technological centre rather than just a large consumer. Masdar is expected to fulfil a commercial role as a base for manufacturing facilities specialising in green technologies, and will be home to around 50,000 people. To this end, the city will host the International Renewable Energy Agency (IRENA), an intergovernmental organisation formed in January 2009 for encouraging the worldwide adoption of renewable energy. With Masdar, Abu Dhabi is thus aiming to kick start an entirely new industrial sector based on sustainable energy.

An architect’s rendering of Masdar’s walled city, designed with narrow and shaded streets to shut out hot desert winds

A Japanese presence is visible in Masdar too. In January 2009, Masdar’s investment arm, the Masdar Clean Tech Fund, announced a venture fund with Japan’s SBI Holdings to invest in firms involved in solar, wind and other alternative energy. The two companies agreed to put in US$10 million each, with each chosen startup to receive around $2 million. It was also reported that the two firms were in talks to boost investment to around $200 million to $300 million, after the first $20 million fund was exhausted. (Reuters, ‘UAE fund to invest in Japan renewable energy firms’, January 22, 2009.)

Japan and the UAE’s nuclear energy

Japan is the world’s third-biggest generator of nuclear power after France and the United States. In response to the first oil shock in 1973, nuclear energy became a national strategic priority. As of 2009, Japan has 55 reactors on line, with a total capacity of 47,577 megawatts (MW), along with two reactors (2,285 MW) under construction and 12 other reactors (16,045 MW) in the pipeline. The on line reactors account for approximately 30% of the country’s electricity capacity, and that is projected to rise to at least 40% by 2017.

Japan imported her first commercial nuclear power reactor from the UK, which began operating in July 1966, and thereafter set about developing its own indigenous expertise. In the 1970s the number of commercially operating reactors was steadily increased by purchasing designs from and cooperating with American firms. By the end of the decade, such technology transfers had enabled companies such as Hitachi, Toshiba and Mitsubishi Heavy Industries to design and build their own nuclear power plants, and subsequently export this technology to neighbouring countries and further afield.

Nuclear cooperation between Japan and GCC member countries was first mooted in May 2007 when then Prime Minister Abe Shinzo visited Qatar. At the time, it was reported he rebuffed his hosts’ request for Japanese assistance in acquiring nuclear technology. However, as France, the US and the UK subsequently inked similar deals with the UAE in 2008 and early 2009, Tokyo performed a volte face. The first rumblings that Japan might change its stance towards the GCC came in May 2008 when Kondo Takeshi, Japan’s Ambassador to Bahrain, revealed that Tokyo was willing to help his host country develop a civilian nuclear power station.

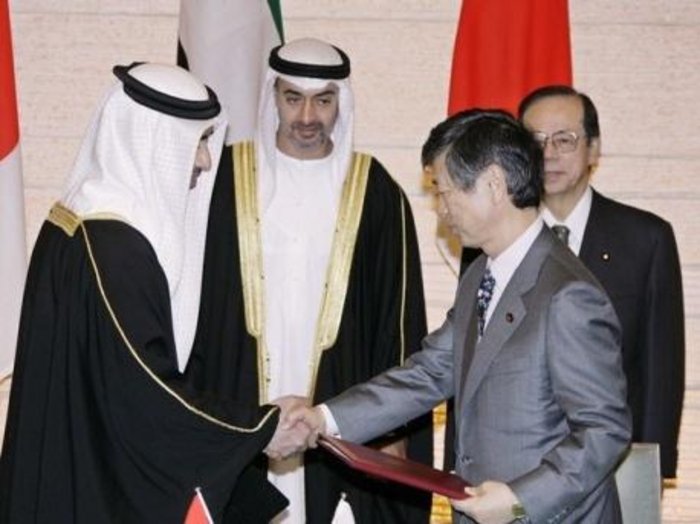

In December 2008 it became apparent that the UAE was locked in talks with the Japanese government over developing civilian nuclear power capabilities. A UAE delegation, led by ENEC president Muhammad al-Hammadi, visited Tokyo in December 2008 for a week, met representatives of Mitsubishi Heavy Industries (MHI), visited a nuclear power plant and toured Hitachi and Toshiba factories. (Megumi Yamanaka, U.A.E. Seeks Japan’s Help to Develop Nuclear Power Plants, December 5, 2008, Bloomberg.) Subsequently, on January 15, 2009, Condoleezza Rice, then US secretary of state, and Sheikh Abdullah bin Zayed al-Nahayan, the UAE foreign minister, signed a bilateral agreement for peaceful nuclear cooperation. Just four days later Ministry of Economy, Trade and Industry (METI) Senior Vice-Minister Yoshikawa Takamori and the UAE’s Foreign Affairs Undersecretary Saif Sultan al-Aryani inked a similar pact defining Japanese assistance to the same programme.

Japanese will focus on the training and education necessary to construct and manage a civilian nuclear plant. Before the partnership can be realised, the two countries are required by international law to sign a treaty guaranteeing that the technology involved will be used for civilian energy only and not for military purposes. Once in place, Japanese manufacturers will be able to sell their reactors to the UAE.

As the fourth major player to have signed a nuclear cooperation agreement with the UAE, Japanese policy has essentially been reactive rather than proactive despite its heavy dependence on GCC oil and, increasingly, gas. Aside from the UAE, it remains to be seen if Tokyo will conclude similar deals other interested parties in the GCC, such as Bahrain and Qatar. Even though ties with the latter in particular are drawing closer due to Qatar’s huge natural gas reserves, established practice points to Japan once again waiting until the US or perhaps other Western powers make the first move.

Left to right, UAE Foreign Minister Sheikh Abdullah bin Zayed al-Nahayan; Abu Dhabi Crown Prince Sheikh Mohammed bin Zayed al-Nahayan; Japanese Foreign Minister Komura Masahiko; and then Japanese Prime Minister Fukuda Yasuo at Fukuda’s Tokyo office, December 2007.

Foreign Investment Competition

Rather than taking the more tortuous route of developing indigenous expertise, the ENEC has been proposing joint-venture schemes with foreign contractors to construct and operate its nuclear power plants. These will be similar to its existing water and electricity set ups in which the government has a 60% stake and 40% is owned by joint venture partners. As the ENEC originally invited nine companies to submit proposals for the construction of its first nuclear power plant, Japan has been facing stiff competition to break into this lucrative new market. The UAE first signed a full nuclear cooperation agreement with France in January 2008, followed by a Memorandum of Understanding with the UK in May 2008 and subsequently the US and Japan in January 2009. On June 22, 2009, South Korea became the latest country to sign such a deal during a visit by Prime Minister Han Seung-soo.

Sheikh Mohammed, UAE Prime Minister and Vice President, with Han Seung-soo, the Korean Prime Minister, June 22, 2009.

In mid-May 2009 ENEC reduced this original nine to a shortlist of three consortia for building and operating the first plant. These are the French team of GdF Suez, Areva and Total; an American-Japanese consortium of GE Hitachi and Westinghouse, a subsidiary of Toshiba; and Korea Electric Power Corporation with Hyundai Engineering & Construction. After the selection process is completed, it is expected that one of these bidders will sign a contract in late 2009 for construction of the first phase of the Al Bayyaa nuclear facility.

Other deals are already in place. A five-year contract was sealed with American firm Thorium Power to help formulate the UAE’s nuclear regulatory agency. The ENEC has also inked a 10-year contract with CH2H Hill, an American project management firm, to oversee the programme. Specifically, CH2H Hill is helping the ENEC choose the main contractors and will manage plant construction. Good Harbor Consulting, whose chairman is former White House national security official Richard Clarke, has been tasked with handling the physical security of the power plants, in particular the safety of the reactors.

Even though the prime contractor has yet to be selected, the French consortium is quietly confident. French President Nicolas Sarkozy has been particularly proactive in nuclear diplomacy since entering office in May 2007. In trying to promote the French civilian nuclear industry worldwide, he has signed several bilateral agreements to build nuclear reactors or extend technical assistance, namely with Morocco, Algeria, Libya, Saudi Arabia, Qatar, UAE, Tunisia, Jordan, India and China. The agreement with the UAE is the most comprehensive of these and was sealed during Sarkozy’s tour of the Middle East in January 2008. French companies Areva and Suez already jointly operate a power and desalination station in Abu Dhabi.

Nuclear cooperation between the UAE and USA has been threatened by revelations of torture committed by Sheikh Issa bin Zayed al Nahyan, a member of the UAE’s ruling family. The Sheikh was videotaped near Abu Dhabi personally brutalising a business associate. To the dismay of American proponents of the nuclear deal, the tape was submitted as evidence in a federal civil law suit filed in Houston against the sheikh by Bassam Nabulsi, another former business partner and a Lebanese-born U.S. citizen resident in Houston. The case fuels criticism of Washington for ignoring human rights to maintain good terms with a rich autocratic regime in a strategically vital region.

Regardless of the outcome however, there seem to be at least three motivating factors behind the sudden scramble to get involved in the UAE’s nuclear industry: consolidating oil and gas agreements; opening up a new market; and setting an example to Iran and others in the region intent on developing nuclear power.

Oil and Gas

In an era of increasing resource nationalism in which host governments seek greater control of the natural resources in their territories, foreign firms have been manoeuvring to retain exploration rights in the UAE. Even in the investment-friendly Emirates, the renewal of existing oil and gas concessions has been a concern. For example, Abu Dhabi Co. for Onshore Operations (ADCO) – in which foreign partners BP, Exxon, Shell, Total and Partex share a 40% stake – faces the expiration of its concession at the end of 2013. In an attempt to generate further competition for its finite resources, Abu Dhabi has been refusing to renew the contract without first soliciting bids from other parties. Indeed, despite calls from Oil Minister Mohammed bin Dhaen Al Hamli for more oil and gas investments, in recent years the Emirates have granted only a handful of concession extensions, mostly to US operations. By contrast, on January 22, 2009, just three days after the signing of the Japan-UAE nuclear cooperation agreement, it was revealed that the Abu Dhabi Oil Company (ADOC) had been granted a 20-year extension of its offshore concession rights in Abu Dhabi. ADOC’s 45-year concession was due to expire in 2012, and it was announced that the firm may also receive additional exploration rights after renewal three years hence. ADOC is a subsidiary of Cosmo Oil, Japan’s fourth biggest refiner, in which the Abu Dhabi government acquired a 20% stake in 2007.

The UAE is Japan’s second largest supplier of oil after Saudi Arabia, supplying 23.8% of Japan’s crude oil imports in 2008. Likewise, Japan is the biggest buyer of oil from the UAE, accounting for almost 40% of the UAE’s total crude exports in 2008. The Tokyo Electric Power Company (TEPCO) is also the biggest buyer of liquefied natural gas (LNG) from Abu Dhabi’s Adgas. Therefore, it is not wholly surprising that ADOC was granted an extension to its oil concession, especially given the contemporaneous signing of the bilateral nuclear cooperation agreement.

Japan’s crude oil imports in 2008 (METI figures).

GCC Zone: 73.7%

Saudi Arabia: 27.8%

UAE: 23.8%

Iran: 11.8%

Qatar: 10.8%

Kuwait: 7.6%

Russia: 3.4%

Indonesia: 3.2%

Sudan: 2.4%

Oman: 2.1%

Saudi-Kuwaiti Neutral Zone (Khafji): 1.6%

Vietnam: 1.5%

Australia: 1.2%

Iraq: 1%

Given that Japan’s so-called ‘New National Energy Strategy’, adopted in late May 2006, calls for stronger relations with resource-rich nations, Tokyo has also been keen to seal a free trade agreement (FTA) with the GCC. However, talks have been dragging on since 2004 without reaching conclusion. Whilst the Japanese government wants an FTA to secure stable energy supplies, the GCC wants to see greater Japanese investment and technology transfers in other sectors besides fossil fuels. Until the recent economic downturn, Japan’s exports of steel and machinery to GCC members were increasing rapidly, while the GCC enjoys a healthy trade surplus with Japan thanks to its oil and gas exports. Indeed, Japan’s trade with the GCC increased by 43.1% from 2007 to 2008 - exports to the GCC rose by 28.4%, and imports increased by 46.3%. (Japan External Trade Organization (JETRO), ‘Japan-GCC Trade for the year 2008’, May 12, 2009.)

The Emirates, in particular, are especially keen to boost Japanese investment in manufacturing in order to help diversify their economy and enhance job opportunities for a burgeoning population. Despite increasingly close commercial ties, foreign direct investment from Japan in the UAE is comparatively small. As part of this energy strategy, in May 2007 the government-backed Japan Bank for International Cooperation (JBIC) signed a partnership agreement with Abu Dhabi National Oil Company (ADNOC), a firm wholly owned by the Abu Dhabi government. There followed, in December 2007, a loan agreement of up to US$3 billion with ADNOC, in order to secure a stable supply of crude oil from the Emirates. This loan enabled Japanese oil companies to sign five-year contracts with ADNOC, guaranteeing delivery of 120,000 barrel of crude oil per day. (Japan Bank for International Cooperation (JBIC) ‘JBIC Signs Loan Agreement with ADNOC’, December 18, 2007.)

In order to consolidate stable oil supplies, it was anticipated that the JBIC will further its loan programme in the coming years to assist the UAE in boosting both oil production and its wider economy. In the meantime, the bolstering of airline connections between the two countries would appear to be the precursor for a closer bilateral relationship. Given Japan’s need for stable oil supplies and the UAE’s desire to incorporate cutting edge technologies into its economic portfolio, the interests of both countries seem to dovetail nicely.

New Markets

Naturally, nuclear cooperation with the UAE would have commercial benefits for both countries. Japan in particular has been looking overseas to maintain the viability of its own nuclear power plant makers — Hitachi/GE, Mitsubishi Heavy Industry and Toshiba — at a time when ambitious plans for domestic expansion are meeting with increasing scepticism from the general public. With sluggish economic growth and a declining population, growth in Japan’s electricity demand has been the lowest in East Asia. This was underlined by a 2007 report from the Japan Electric Power Survey Committee, a body which includes utilities such as TEPCO and manufacturers like Hitachi. It projected that domestic electricity demand will increase by only 0.9% per annum to March 2017, a fall from average annual demand growth of 1.7% in the decade to March 2006. It cited increasing energy conservation as a further contributing factor to the declining growth rate. (Reuters, ‘Japan Electricity Demand Growth to Slow –Study’, March 6, 2007.)

Such a prognosis has prompted the government to assist Japan’s nuclear industry to secure contracts in Asia where surging power demand is creating new opportunities for nuclear firms. Officially codified in August 2006 when the Ministry of Economy, Trade and Industry (METI) released its Nuclear Power National Plan to “actively support the global development of the Japanese nuclear industry”, this approach coincides with increasing domestic concerns over the industry’s patchy safety record. In 2008 Japan’s Nuclear and Industrial Safety Agency (NISA) established its International Nuclear Power Safety Working Group to stimulate cooperation with emerging nuclear markets, mostly in Asia, in the face of increasing competition from South Korea and Russia.

Agreements with several governments have since followed, including a deal in May 2009 with Russia, which provides for the transfer of Japanese technology overseas and the sale of raw nuclear materials to Japan. Uzbekistan has also signed deals in 2009 with a couple of Japanese firms for uranium extraction, whilst Japan opened a major uranium mine in Kazakhstan in April 2009. Indeed, Tokyo sees nuclear power as one area in which it still has a competitive advantage over most of its rivals, and therefore nuclear cooperation is one arena in which Japan can exercise a degree of leadership and vision, particularly in Asia.

Until the early 1990s, however, the Japanese nuclear industry maintained a largely domestic focus, aside from uranium exploration and mine investment in Australia and Canada. Since then, Japan’s three nuclear power plant makers have expanded overseas via acquisitions of and alliances with foreign nuclear companies. For example, General Electric and Hitachi merged their nuclear energy operations in July 2007, a year after Toshiba purchased American reactor builder Westinghouse from British Nuclear Fuels.

As well as pushing for overseas expansion, Tokyo has spent much of this decade promoting the nuclear option domestically, despite stagnant electricity demand and safety scandals. A new Energy Policy Law of June 2002 consolidated greater government control over energy infrastructure, and also aimed to decrease dependence on fossil fuels. In November that same year it was announced that a tax on coal would join those already charged on other fossil fuels, and would be accompanied by a 15.7% reduction in development taxes which apply to nuclear power generation. The reasoning was twofold: to diversify Japan’s energy supplies and simultaneously reduce carbon emissions under the Kyoto Protocol, both of which feed into an enhanced role for nuclear power. In 2008 the METI subsequently predicted that nuclear’s share would reach 41.5% of total capacity by 2017, despite the forced shut down of the Kashiwazaki-Kariwa nuclear power plant in July 2007 which accounted for a decline in nuclear’s share to 26% in 2007. (World Nuclear Association, ‘Nuclear Power in Japan’, May 2009).

Kashiwazaki-Kariwa was just one of a series of accidents and scandals that have shattered public confidence in nuclear power in Japan. These have included two fatal accidents: at Tokaimura in 1999, when poorly trained workers caused an uncontrolled nuclear chain reaction, releasing radiation which killed two staff and forced the evacuation of thousands of local residents; and at Mihama in 2004 when super-heated steam leaked through a hole in a pipe that feeds the plant’s turbine facility, killing four and injuring seven others at the facility. These disasters revealed a cover-up culture in which employees’ loyalty to their companies permitted lax safety measures to go unchallenged. (Further examples include a 2002 scandal over widespread data falsification at TEPCO’s nuclear power plants. The utility firm had falsified inspection records when trying to hide cracks in reactor shrouds in 13 of its 17 reactors. The World Nuclear Industry Status Report 2007.) As a result, the Japanese government has enforced stricter controls under a reorganised structure of agencies responsible for overseeing nuclear power. Nevertheless, these could not prevent the enforced shut down of TEPCO’s Kashiwazaki-Kariwa plant in the wake of the Niigata Chuetsu-Oki earthquake which was stronger than the plant was designed for. It remained completely off line for almost 22 months although an IAEA inspection concluded it suffered “no significant damage”. After seismic upgrades, in February 2009 Japan’s Nuclear Safety Commission (NSC) agreed that one unit (unit 7) could be restarted on a trial basis, which began on May 9, 2009, for 50 days of testing.

The Kashiwazaki-Kariwa nuclear power plant.

In order to spur domestic consumption and capitalise on new export markets, the ruling Liberal Democratic Party has stressed the need for Japan to become a world leader in the new generation of fast breeder reactors (FBRs). Mitsubishi was subsequently chosen in April 2007 to spearhead this ambitious scheme. There are not many countries that can afford, either technically or financially, the kind of advanced nuclear reactors that the Japanese and other consortia are offering. The UAE is a perfect new market for advanced nuclear power plant makers. How Japan manages its existing reactors, as well as its development of new reactors, will be watched very closely by those in the market for civilian nuclear technology.

Setting an Example

Another reason for Western and Japanese support has been the UAE commitment to a strictly civilian nuclear programme. Indeed, the UAE has been lauded as setting a good example to would-be nuclear powers in the Middle East, such as Iran, due to its decision not to enrich uranium or to reprocess spent fuel. For the West, the sale of civilian nuclear technologies to the UAE is also a response to Iranian accusations of ‘double standards’ in denying the benefits of peaceful energy technology to other states. Iranian government officials have thus called these efforts ‘nuclear apartheid’, whereby just a privileged few states (chiefly the five permanent members of the United Nations Security Council) have the right to develop nuclear technology whilst denying other states the same right. Such critics contend that these privileged states hypocritically allow only their allies to acquire nuclear technology.

The deal is also considered a standard bearer for other regional states, in particular Egypt, keen to develop their own nuclear schemes. Supporters of the UAE’s programme hope it will constitute a basis for enhanced regional cooperation in areas such as electricity sharing and human resources as well as transparency in regulatory oversight.

The sale of nuclear technology would undoubtedly strengthen the strategic interests between the contracting country and the Emirates. Indeed, all five powers see their respective nuclear cooperation agreements as consolidating a key security relationship in the Middle East. For instance, the UAE hosts more than 2,000 US military personnel, and more American naval ships visit the UAE than any other overseas destination. The US Air Force also operates the Al Dhafra Air Base and both countries share intelligence.

In addition to such logistical support, the UAE military is part of the NATO mission to Afghanistan and a valuable customer for American defence contractors. In September 2008, Congress was informed of the proposed sale to the UAE of the Theatre High Altitude Air Defence (THAAD) system, plus the Patriot PAC-3 and AMRAM missiles, in an arms deal worth an estimated US$6.95 billion. In February 2009 it was announced that the UAE was also buying 224 AIM-120C-7 advanced air-to-air missiles for its F-16 jets from American arms manufacturer Raytheon. In the same month, American firms Boeing and Lockheed Martin also secured contracts worth US$2.8 billion from the Emirates for military transport planes. These deals were part of a US$5 billion buying spree the Emirati government conducted at the 2009 IDEX (International Defence Exhibition) in Abu Dhabi, one of the world’s biggest arms fairs. (Stanley Carvalho, ‘Iran neighbour UAE spends $5 bln on arms deals’, Reuters, February 26, 2009.)

Whilst keen to support the UAE politically and militarily, all four major players are intent on ensuring that civilian nuclear programmes will not result in regional nuclear proliferation. Tokyo has been among the staunchest supporters of reinforcing nuclear non-proliferation measures. The revelations that Saddam Hussein’s Iraq was secretly developing nuclear weapons prior to the Gulf War of 1990 were deeply shocking. His July 1990 threat to attack Israel with chemical weapons prompted Israel to hint at a nuclear response, raising the spectre of nuclear conflict in the Middle East. It is now believed that an Iranian nuclear weapons capability would escalate tensions in the Middle East again, alter the regional balance of power, and even precipitate the collapse of the whole non-proliferation regime.

Iran’s nuclear programme is controversial chiefly because of Tehran’s reluctance to divulge details of its enrichment and reprocessing activities to the IAEA. It is widely believed that Iran had a nuclear weapons programme until 2003, which now lies dormant, but the IAEA has yet to unearth any concrete evidence that Iran has redirected nuclear material for weapons use. Nevertheless, in February 2006 Tehran’s lack of cooperation with the IAEA was enough for the United Nations Security Council to levy wide-ranging sanctions after Iran refused to suspend enrichment. Tehran maintains that it has only enriched uranium to less than 5%, just enough to fuel a nuclear power plant, and has vehemently protested the sanctions.

In order to assuage fears of nuclear proliferation in the Middle East therefore, the UAE has contracted American firm Thorium Power to help establish a fully independent Federal Authority for Nuclear Regulation (FANR), reporting to a senior American regulator. Proponents argue that cooperation with the UAE is a major boost for global non-proliferation as many countries increasingly look to nuclear energy to reduce carbon emissions whilst simultaneously expanding their power grids. As such it might even breathe new life into the ailing NPT regime, although this is by no means assured as other states are yet to commit to the same kind of regulation as the UAE. Whilst some, such as Bahrain, have shown no interest in enrichment and reprocessing technologies, others in the Middle East may prefer to keep their options open.

Nevertheless, with around 40 developing countries, 11 in the Middle East, expressing an interest in harnessing civilian nuclear power, there is some unease about the prospect of nuclear arms proliferation. Indeed, opponents such as European Renewable Energy Council Policy Director Oliver Schafer argue that it is “impossible” to completely prevent dual use of civil nuclear technology. He argues that, “When it comes to building reactors in more unsafe regions with more terrorism, proliferation is definitely an issue.” (Dominic Moran, ‘The UAE Nuclear Debate’, International Relations and Security Network (ISN), March 6, 2009.) Opponents also fear that the deal may spark increased nuclear development in the Middle East, as other regional powers take advantage of the weakness of the NPT. This perception assumes that other regional players would follow a different route to the UAE.

Moreover, Dubai was tainted by its implication in the AQ Khan illicit nuclear network whose customers included Iran, Libya, North Korea and Saddam Hussein’s Iraq. Khan’s office in Dubai played a key role, from where smuggled nuclear materials were shipped to Iraq and Libya. The UAE’s commitment to total transparency in its nuclear quest has been driven partly by the need to strengthen its relations with the US and other powers following this lapse. Ben Rhode, an analyst at the International Institute for Strategic Studies, noted that, “Abu Dhabi has been keen for Dubai to clean up its act. And they put in an export control law. If you are an Iranian expat living in the UAE it is a lot harder to set up these businesses or to open a bank account.” However, Rhode also states that certain individuals are able to circumvent the rules. (Dominic Moran, ‘The UAE Nuclear Debate’, International Relations and Security Network (ISN), March 6, 2009.) Indeed, more recently the US Congress has become aware of transhipments to Iran through the UAE of militarily useful technology. These have apparently included computer chips supplied by Iran and used in the homemade bombs of Iraqi insurgents which target American and Coalition troops.

Indeed, the proliferation debate is at the centre of the controversy over the UAE’s nuclear programme. Traditionally, it has enjoyed better relations with Tehran than many of its GCC neighbours and Iran is one of its major trading partners. For instance, the Jebel Ali Free Zone in Dubai is Iran’s largest source of foreign commodities and consumables servicing its growing middle class, and around 200,000 Iranians presently live in the emirate. Furthermore, approximately half of the refined gasoline consumed in Iran is also transhipped through the UAE. Hardliners in Congress believe the US and its allies should use leverage over the UAE’s nuclear programme to threaten to block these imports unless Iran changes its confrontational stance towards the US and its allies. (Henry Sokolski, ‘Nuclear Cooperation with the UAE?,’ December 15, 2008.) In the last few years, however, the Emirate has made numerous entreaties to Iran to abstain from nuclear weapons development, and its nascent nuclear programme is designed in part to persuade Tehran to follow a similar path of non-enrichment.

Indeed, the bilateral relationship has been put under increasing strain in recent years over the development of Iran’s Bushehr reactor and Natanz enrichment facility. These ties suffered a further blow with Tehran’s 2008 decision to station maritime personnel on the Persian Gulf island of Abu Musa, reigniting an old territorial dispute between the two states. Abu Musa is very close to vital shipping lanes. Fears of the militarisation of the Iranian nuclear program; Tehran’s naval exercises and missile testing; and its support for militancy in Iraq, Lebanon and the Palestinian Territories are all a cause for concern around the Gulf. These fears were further stoked when Iran’s elite Revolutionary Guards took control of the Strait of Hormuz in September 2008. This has allowed the Guards to wield greater power than at any point since the Islamic revolution’s early days.

Other motivations for nuclear diplomacy with the UAE exist. Nuclear cooperation agreements are a ‘good news story’ which enable the parties involved to portray a positive image in the Middle East, without any reference to Palestine or Israel. Indeed, Sarkozy has even stated that extending nuclear cooperation to Muslim countries could help prevent Huntington’s clash of civilisations prophecy. (See Samuel P. Huntington, ‘The Clash of Civilizations: And the Remaking of World Order’, Pocket Books, 1998. Its main thesis is that tensions between cultural and religious identities will be the chief driver of conflict in the post-Cold War world.) Nuclear also represents a practical option to reduce greenhouse emissions whilst retaining access to energy.

Conclusion

The UAE’s commitment to transparency in its nuclear quest has attracted widespread international support. This is because it has stressed that it will not enrich uranium itself but import nuclear fuel for its plants. These supplies will not only come from a foreign partner, but the UAE will also return all spent nuclear fuel rather than reprocess it.

For Japan and the other prospective contractors, there are at least three main motivating factors. Firstly, Japan in particular is heavily dependent on oil supplies from the UAE and other GCC members. To this end, it has been trying to tie both the GCC as a grouping and the UAE individually into an FTA in which stable oil and gas supplies would be guaranteed. Tokyo is therefore hoping that nuclear cooperation with the UAE will have a positive spillover effect into stable and secure oil supplies. Secondly, the Japanese nuclear industry is keen to develop new markets, especially one as potentially lucrative as the UAE’s. There are not many countries that can afford, either technically or financially, the kind of advanced nuclear reactors that the various consortia are offering. Consequently, foreign nuclear firms will be looking to the UAE for signs that new markets are economically and politically viable in other GCC member states. Thirdly, it is hoped that the UAE’s nuclear programme will set new standards of transparency and regulatory rigour, thus setting an example to close neighbour Iran and other potential nuclear power developers in the Middle East. As such it might even breathe new life into the ailing NPT regime, although this is by no means assured as the other interested states are yet to commit to the same kind of regulation as the UAE.

The UAE’s nuclear programme will be watched closely for other reasons too. Many governments will be waiting to see if any change of tone or policy is forthcoming from Iran’s leadership over its own nuclear programme. These same observers will also be interested to see if the UAE’s decision to reject uranium enrichment and reprocessing will influence other potential developers of nuclear power in the Middle East and North Africa to follow a similar path.

As with other aspects of foreign policy towards the Middle East, such as Iran and the Palestine issue, Tokyo has closely followed the American lead regarding nuclear power for the UAE. However, Tokyo views nuclear power as an area in which it still holds a competitive advantage over most of its rivals, and nuclear cooperation is seen as an arena in which Japan can exercise a degree of leadership and vision, particularly in Asia. The UAE deal is one step forward. It remains to be seen, however, if Tokyo will conclude similar deals with other members of the GCC, all of whom have signalled their interest in nuclear power. Like the UAE, Bahrain has also disavowed enrichment and reprocessing. Likewise, Japan’s ties with Qatar are drawing closer due to that country’s huge natural gas reserves. Nevertheless, established practice points to Japan once again waiting until the US or other Western powers make the first substantive move before signing a comprehensive nuclear cooperation agreement with another GCC state. In this sense, the various deals the UAE has concluded contain significantly more substance than its neighbours’ bilateral nuclear cooperation agreements.

Naturally, the UAE has its own interests in developing a civilian nuclear programme. Nuclear power will increase the sustainability of its oil and gas reserves, simultaneously allowing more of these resources to be exported, thus boosting earnings. The UAE and the other five members of the GCC rely exclusively on fossil fuels for electricity generation, and water desalination also consumes large qualities of oil and gas. Rising living standards, population and infrastructure requires ever greater electricity and desalination capacity which the UAE wants nuclear power to meet, whilst maintaining economic growth by exporting its natural resources.

In addition to these economic benefits, the UAE has political aspirations for its nuclear programme. It is not alone among Arab states concerned that Iran’s nuclear programme could result in regional nuclear proliferation. Therefore, the UAE’s own nuclear plans constitute a direct appeal to Iran to demonstrate greater nuclear transparency. In recent years the traditionally close UAE-Iran relationship has been strained by the development of Iran’s Bushehr reactor and Natanz enrichment facility. These ties suffered a further blow with Tehran’s 2008 decision to station navy personnel on the Persian Gulf island of Abu Musa, reigniting an old territorial dispute between the two states. Nevertheless, the UAE’s plans could backfire as its significant arms spending is likely to further strain bilateral relations, as might its nuclear engagement with some of Iran’s fiercest critics.

David Adam Stott is an associate professor at the University of Kitakyushu, Japan and an Asia-Pacific Journal associate. He wrote this article for The Asia-Pacific Journal

Recommended citation: David Adam Stott, "Japan an

SOURCE

Saturday, August 15, 2009

Tuesday, August 4, 2009

Global warming - FAQs

Global warming

From Wikipedia, the free encyclopedia

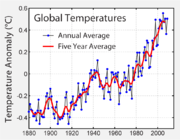

Global warming is the increase in the average temperature of the Earth's near-surface air and oceans since the mid-20th century and its projected continuation. Global surface temperature increased 0.74 ± 0.18 °C (1.33 ± 0.32 °F) during the last century.[1][A] The Intergovernmental Panel on Climate Change(IPCC) concludes that increasing greenhouse gas concentrations resulting from human activity such asfossil fuel burning and deforestation caused most of the observed temperature increase since the middle of the 20th century.[1] The IPCC also concludes that variations in natural phenomena such as solar radiationand volcanoes produced most of the warming from pre-industrial times to 1950 and had a small cooling effect afterward.[2][3] These basic conclusions have been endorsed by more than 45 scientific societies and academies of science,[B] including all of the national academies of science of the major industrialized countries.[4] A small number of scientists dispute the consensus view.

Climate model projections summarized in the latest IPCC report indicate that the global surface temperature will probably rise a further 1.1 to 6.4 °C (2.0 to 11.5 °F) during the twenty-first century.[1] The uncertainty in this estimate arises from the use of models with differing sensitivity to greenhouse gas concentrations and the use of differing estimates of future greenhouse gas emissions. Some other uncertainties include how warming and related changes will vary from region to region around the globe. Most studies focus on the period up to the year 2100. However, warming is expected to continue beyond 2100 even if emissions stop, because of the large heat capacity of the oceans and the long lifetime of carbon dioxide in the atmosphere.[5][6]

An increase in global temperature will cause sea levels to rise and will change the amount and pattern ofprecipitation, probably including expansion of subtropical deserts.[7] The continuing retreat of glaciers,permafrost and sea ice is expected, with warming being strongest in the Arctic. Other likely effects include increases in the intensity of extreme weather events, species extinctions, and changes in agricultural yields.

Political and public debate continues regarding climate change, and what actions (if any) to take in response. The available options aremitigation to reduce further emissions; adaptation to reduce the damage caused by warming; and, more speculatively, geoengineering to reverse global warming. Most national governments have signed and ratified the Kyoto Protocol aimed at reducing greenhouse gas emissions.

Contents[hide] |

1 comments:

Post a Comment

Please leave a civilized comment. Use of bad language is strictly prohibited. I always welcome a healthy discussion.If you want to carry on the discussion further with me (or want me to reply to your comment) then please email me at: adammalthus-blog@yahoo.com. Privately we can continue the discussion.